how much tax is taken out of my first paycheck

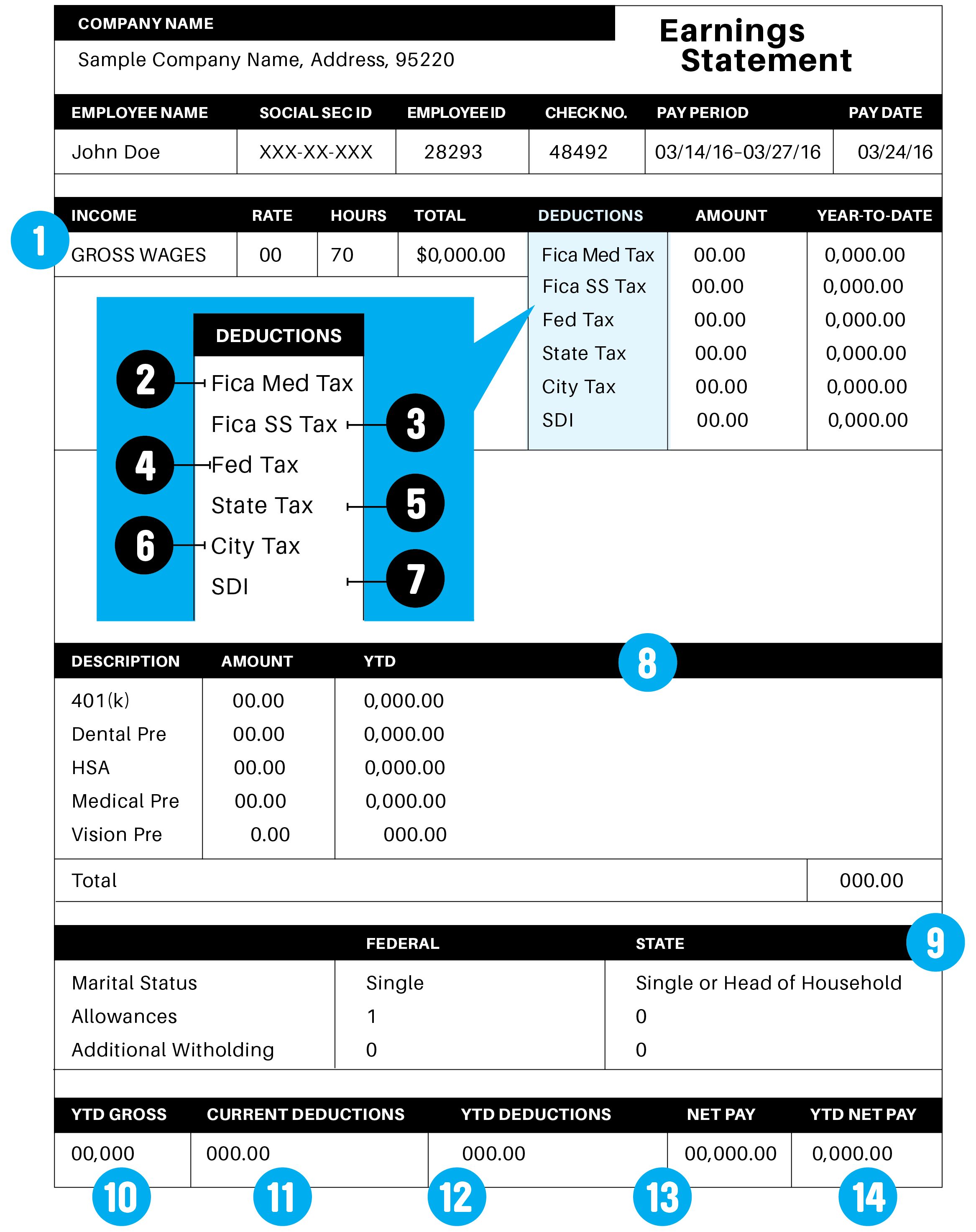

Income amounts over 40525 81050. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62.

6 Reasons Your Paycheck Is Smaller Than Expected Cleverism

If you increase your contributions your paychecks will get smaller.

. However the 62 that you pay only applies to income up to the Social Security tax cap which for 2020 is 137700 up from 132900 in 2019. These are the federal tax brackets for the taxes youll file in 2022 on the money you made in 2021. Get ready today to file 2019 federal income tax returns.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. For a single taxpayer a 1000 biweekly check means an annual gross income of 26000. For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. That 14 is your effective tax rate. 12 on the next 29774 357288.

The amount withheld per paycheck is 4150 divided by. Youd pay a total of 685860 in taxes on 50000 of. Youll see 62 withheld from your.

Choose an estimated withholding amount that works for you. See how your refund take-home pay or tax due are affected by withholding amount. Any of these far-reaching changes could affect refund amounts.

Use this tool to. Income amounts up to 9950 singles 19900 married couples filing jointly. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

IR-2019-178 Get Ready for Taxes. Income amounts over 9950 19900. Your employer matches your Medicare and Social Security contributions so the total payment is doubled.

How It Works. Federal income taxes are paid in tiers. Your employer will withhold 145 of your wages for Medicare taxes each pay period and 62 in Social Security taxes.

Also Know how much in taxes is taken out of my paycheck. If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes. Additionally Social Security and Medicaid are withheld from your paycheck during every pay period.

22 on the last 10526 231572. For a single filer the first 9875 you earn is taxed at 10. If youre single and you make 50000 after subtracting deductions exemptions etc you would pay.

Estimate your federal income tax withholding. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket.

Income amounts over 86375 172750. 10 on the first 9700 970.

Pin On Budgeting For Beginners

First Paycheck What To Know Fidelity

Congratulations To My Brother On His First Paycheck And His Discovery Of Taxes Best Funny Pictures Funny Photos Hilarious

7 Paycheck Laws Your Boss Could Be Breaking Fortune

Paycheck Taxes Federal State Local Withholding H R Block

5 Things Your High School Teen Needs To Know About Her First Job

Budget Printable Editable Paycheck Budgeting Personal Etsy Paycheck Budget Budgeting Budget Printables

Paycheck Calculator Online For Per Pay Period Create W 4

6 Reasons Your Paycheck Is Smaller Than Expected Cleverism

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

7 Conversations To Have Once Your Teen Starts Earning A Paycheck

The First Thing You Should Do With Every Paycheck Gobankingrates

What Everything On Your Pay Stub Means Money

The Best Ways To Spend Your Tax Refund In 2021

Last Paycheck Laws When Do I Get A Paycheck After Leaving A Job Findlaw

Understanding Your Paycheck Credit Com

Teenager Is Disappointed With His First Paycheck This Teenager S Reaction To Getting Taxed On His First Paycheck Is Hilarious Via Jukin Media By Daily Mail Facebook